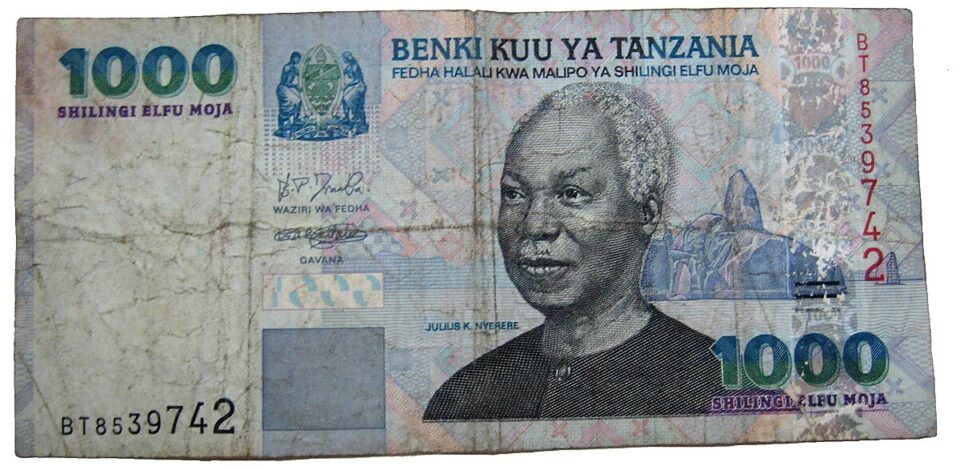

DAR ES SALAAM, Tanzania – The government of Tanzania has prohibited the use of foreign currencies for the purchase and sale of goods and services within its borders, marking a sweeping shift in monetary policy aimed at reinforcing the role of the Tanzanian shilling in the national economy.

In a statement issued on May 2, the Bank of Tanzania said the new rules—first introduced in late March—require that all domestic transactions be conducted exclusively in the local currency. The measure criminalizes the quoting, advertising, or payment of prices in foreign currencies such as the U.S. dollar or euro.

“No business or individual shall set, demand, or receive payment in a foreign currency,” the central bank said in a directive, emphasizing that refusal to accept the Tanzanian shilling is now illegal.

The policy also restricts the use of foreign denominations in legal contracts. Any agreement signed or renewed after March 28 must be denominated in shillings unless explicitly exempted under the law. Existing contracts involving foreign currency will be honored only for a limited period and under close regulatory scrutiny.

Foreign nationals and tourists, however, will still be able to transact in foreign currencies—but only through approved channels. These include licensed banks and foreign exchange bureaus. Visitors may also use credit or debit cards and authorized mobile payment platforms.

The move comes as the shilling, once hailed as the world’s top-performing currency in the second half of 2024, has entered a period of decline.

According to the central bank, the shilling appreciated by 9.51 percent between July and December of last year. But from April 2024 to April 2025, it has fallen by 3.6 percent against the U.S. dollar.

Analysts attribute the currency’s recent slump to seasonal fluctuations in foreign exchange inflows and Tanzania’s market-driven exchange rate regime, which allows the shilling’s value to fluctuate in response to supply and demand. The Bank of Tanzania has maintained that it intervenes only when necessary to preserve market stability.

The foreign currency crackdown is likely to have significant implications for sectors that traditionally rely on dollar-based transactions, including real estate, hospitality, and private education. It may also test the resilience of the business community amid tightening liquidity and growing concerns over foreign investment flows.

While officials have framed the policy as a move to reinforce monetary sovereignty and protect consumers, critics say it could disrupt business operations and dampen investor confidence if not carefully implemented.

The central bank has not announced penalties for noncompliance, but warned that enforcement mechanisms are being put in place.