Bank of Uganda (BoU) deputy governor has warned that as regulators of commercial banks, they are ready to close all deposit-taking financial commercial institutions that put clients’ money at risk.

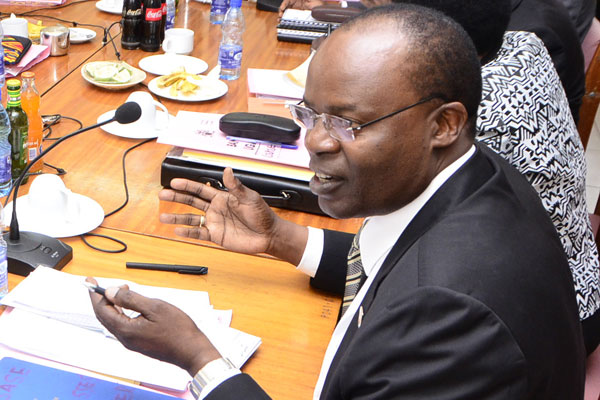

Dr Louis Kasekende says some sections of the public should stop misjudging and attacking the Central Bank because of the number of banks it has closed since it has saved hundreds of depositors from losing their money.

“Before we close any bank, we impose constraints on activities of the bank which are threatening depositors’ money,” he said.

Speaking at the seventh International Leadership Conference at the Golf Course View Hotel in Entebbe on Wednesday, Dr Kasekende said that since 2004, no single depositor has lost money to a poor performing bank because it is the responsibility of BoU to protect depositors’ cash.

“When we closed NBC Bank, all the depositors were able to transact at Crane Bank. When we closed Crane Bank, depositors were able to transact at DFCU and when NC bank had issues in Kenya, we sold it to Exim Bank without a single depositor losing a shilling,” he said.

Asked why an award-winning bank like Crane Bank which was highly ranked and expanding was closed, Dr Kasekende said before such banks are licenced, they present very good proposals which they fail to operationalise.

“It is very expensive to get a bank on its feet because of the operational costs.

Some of these banks are like babies that remain stunted but what is important is to avoid misrepresenting the financial and governance issues,” he said.

He said he would love to explain what happened to Crane Bank but he is constrained by the on-going court case.

“The day we win the court case, call me and I will tell you everything that was happening,” he said.

BoU sued Mr Ruparelia and his Meera Investments in July, accusing the tycoon of fleecing the then Crane Bank of Shs397b in disputed transactions, a claim the businessman denies in his countersuit filed in the High Court recently.

The leadership conference is an initiative by Makerere University Business School (MUBS) to bring together government leaders and academia to discuss matters affecting the economy.

Prof. Wasswa Balunywa the principal MUBS said they invited the deputy governor to open the conference because of the role he played in stabilising Uganda’s economy.

“When President Museveni came to power in 1986, he was a communist but Dr Kasekende was instrumental in making him change to capitalism to allow market forces to operate,” he said.